How to Improve the State of Public Finances?

Author: Beata Roguska

|

2024-08-02

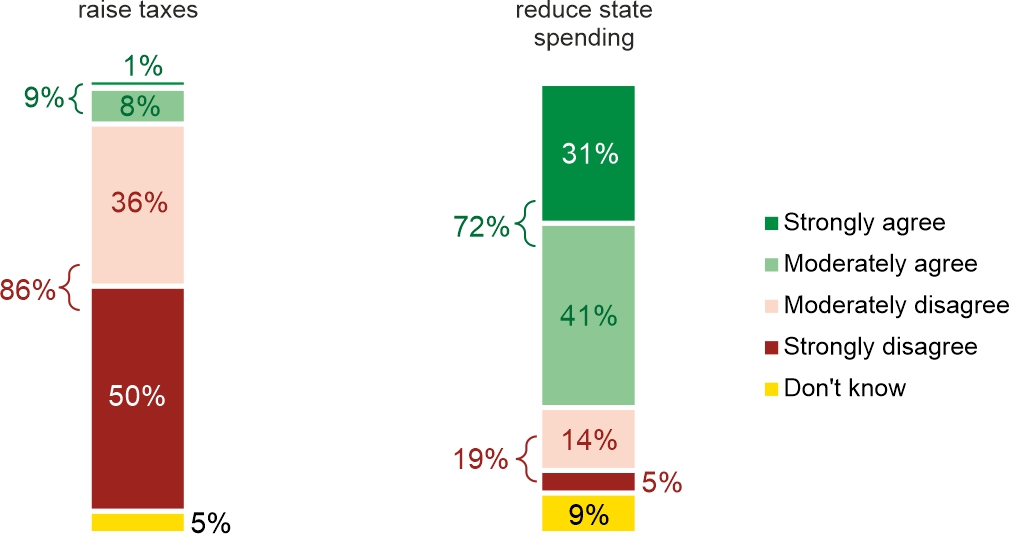

The EU Council, based on the recommendation of the European Commission, imposed an excessive deficit procedure on Poland, as well as several other EU countries. Such a procedure can be launched if the public finance sector deficit in a given EU Member State exceeds 3% of GDP or public debt is higher than 60% of GDP. According to data from the Central Statistical Office, the deficit of the general government sector in 2023 in relation to GDP was much higher (5.1%). Initiating the excessive deficit procedure means that a corrective action plan must be presented. In the July survey, we decided to ask our respondents about their acceptance of possible actions aimed at improving the state of public finances. According to the majority of respondents (72%), in the current financial situation of the country, a better solution would be to limit expenditure, rather than increase the tax burden. Only 9% of respondents support raising taxes.

In the current financial situation in Poland, do you agree that it is necessary to:

We asked a similar questions in January 2023, when the country's financial situation was better than it is now, but inflation was still high and Poles were suffering from rising prices. At that time, 75% of respondents expressed support for limiting expenditure (which is 3 percentage points more than now), while only 2% expressed support for increasing the tax burden (which is 7 points less than now).

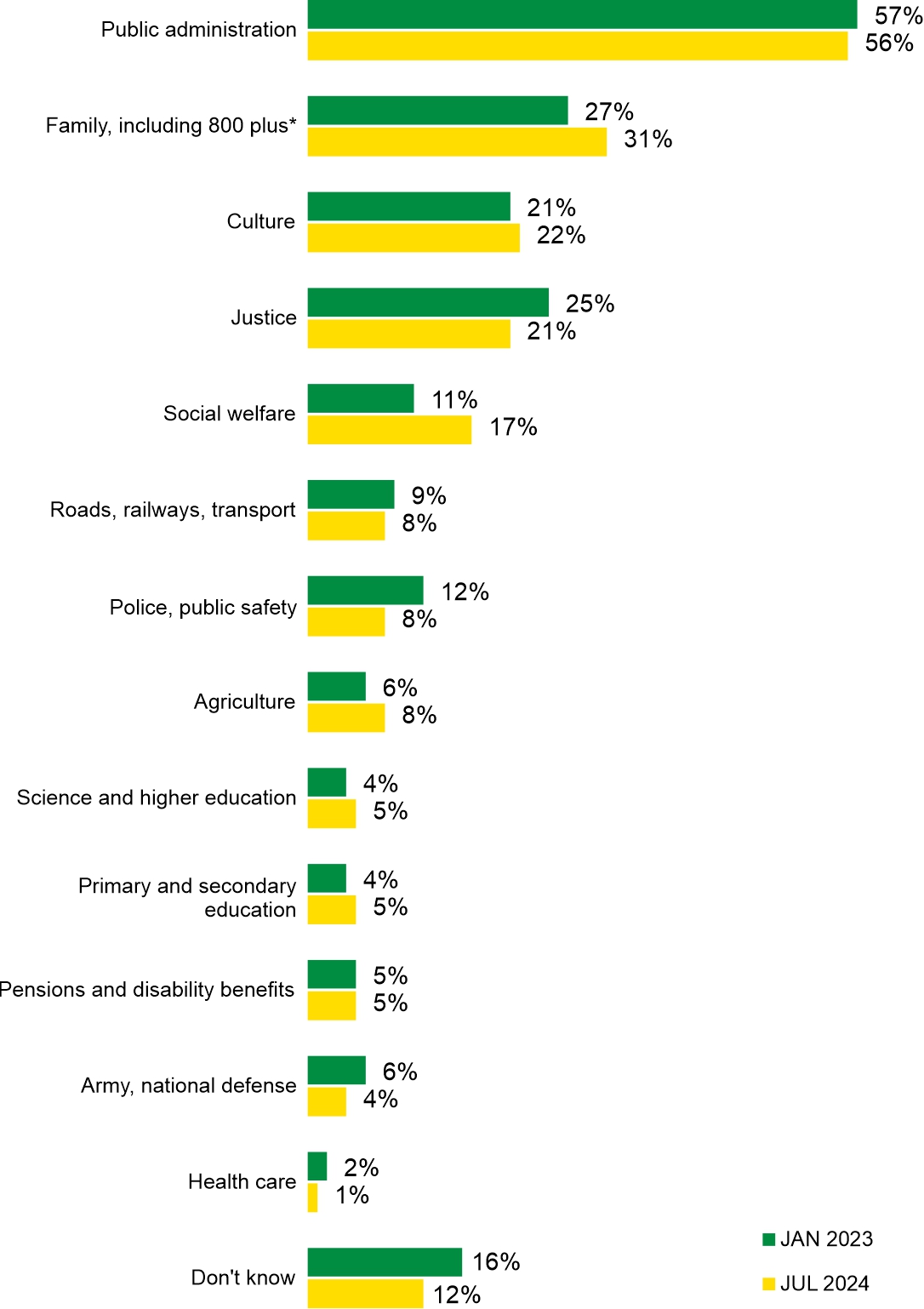

After a year and a half, we also asked in which areas they would look for savings if it turned out to be necessary to limit state expenditure. Respondents could choose a maximum of three. The indications are quite similar to 2023. By far the largest number of people believe that it would be possible to save money on public administration expenditure (56%). Nearly one-third (31%) mention family support expenditure in this context, including the payment of child benefit under the Family 800 plus program (formerly 500 plus). More than one in five respondents would look for savings primarily in areas such as culture (22%) or the justice system (21%). A relatively large percentage of people (17%) see opportunities to save on social welfare spending. Less than 10% indicated the remaining areas listed in the question.

If it were necessary to reduce state spending, in which areas should savings be sought?

*In January 2023: "Family, including 500 plus".

The percentages do not add up to 100% because respondents could choose more than one answer.

The percentages do not add up to 100% because respondents could choose more than one answer.

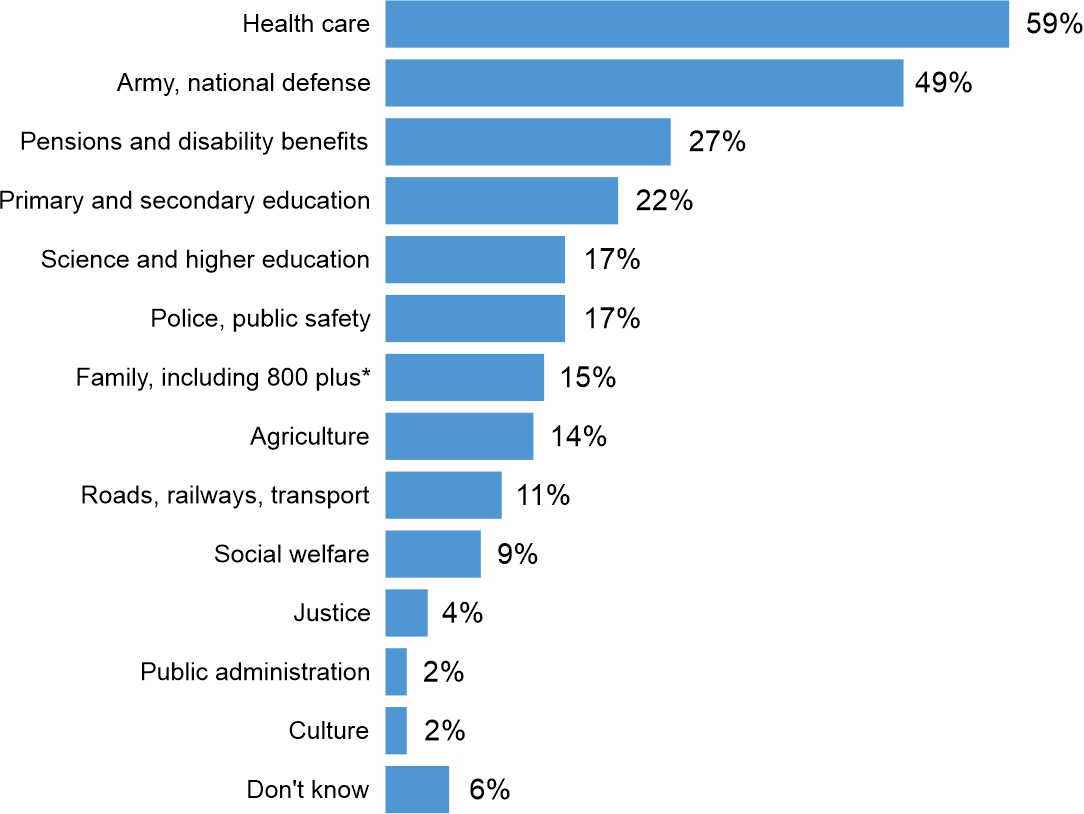

In the July survey, in addition to asking about areas where savings could be sought, we asked an additional, "mirror" question about areas and goals that should not be cut. According to the public, the priority areas that should not be cut include health care (indicated by 59% of respondents) and the army, i.e. national defense (49%). Other items were mentioned much less frequently. A significant percentage of respondents indicated the need to maintain spending on pensions and disability benefits (27%): this was the third most frequently selected item. Next, as requiring financing at least at the current level, were such areas as: primary and secondary education (22%), science and higher education (17%) and police and public safety (17%).

In which areas should spending not be reduced at present?

*In January 2023: "Family, including 500 plus".

The percentages do not add up to 100% because respondents could choose more than one answer.

The percentages do not add up to 100% because respondents could choose more than one answer.

More information about this topic can be found in CBOS report in Polish: “How to Improve the State of Public Finances?", August 2024. Fieldwork dates for the sample: July 2024, N=1076. The random sample is representative for adult population of Poland.